Payroll

Alleviate the headaches and liability of payroll processing with IRM. As your partner, IRM can free up valuable time by administering the payroll process, deductions, taxes and direct deposits, so you have more time to focus on other important details involved with running your company.

ACCURATE

Accurate payroll processing, including calculating wages, payroll deductions and tips.

MAINTAIN RECORDS

Maintaining payroll records, including child support, benefit deductions and wage garnishments

TAX FILING

Preparing and depositing local, state, and federal withholding taxes (i.e. 940, 941, State Unemployment, etc.)

COMPLIANCE

Federal, State and Local tax & employment law compliance

JOB COSTING

CERTIFIED PAYROLL

CUSTOM & STANDARD REPORTS

TIME CLOCK INTEGRATION

TIMELY CHECK DELIVERY

DIRECT DEPOSITS

YEAR-END W-2 PROCESSING

ACCOUNTING IMPORTS

We Believe in Quality Service, Not Voicemail

When you need us, you can reach us! Our standard is to not even let you hear our voicemail. We know the importance of taking exceptional care of our clients and have a 95%+ retention rate to show for it. We also take great care of our employees, so you don’t experience turnaround with your account specialist, and you benefit from the many years of expertise longevity provides.

We provide prompt and friendly service in payroll administration. Having a designated payroll specialist at IRM allows us to better understand the unique needs of your business. Our representatives are extensively trained and eager to exceed your expectations, ensuring your experience with IRM is truly the best. In addition, IRM will stay abreast of changes in state and federal laws and ensure timely compliance with the changes as needed.

Integrated With Your Other HR Tools

Your payroll data is automatically integrated with other HR Cloud modules, so you never have to rekey anything from one system to another.

You can quickly review timesheets, process your payrolls, and even see payroll status in real-time. Access to payroll data is granted to individuals in your organization as needed, and you can even control what specific data, fields and reports each individual can see. So everything is safe, and your team only sees the data they need.

Leaders in Payroll & Workforce Solutions.

“It is great to be hooked up with a pro like you, as well as your organization.” “The payroll is perfect as always!” “Thanks, you are the best.”

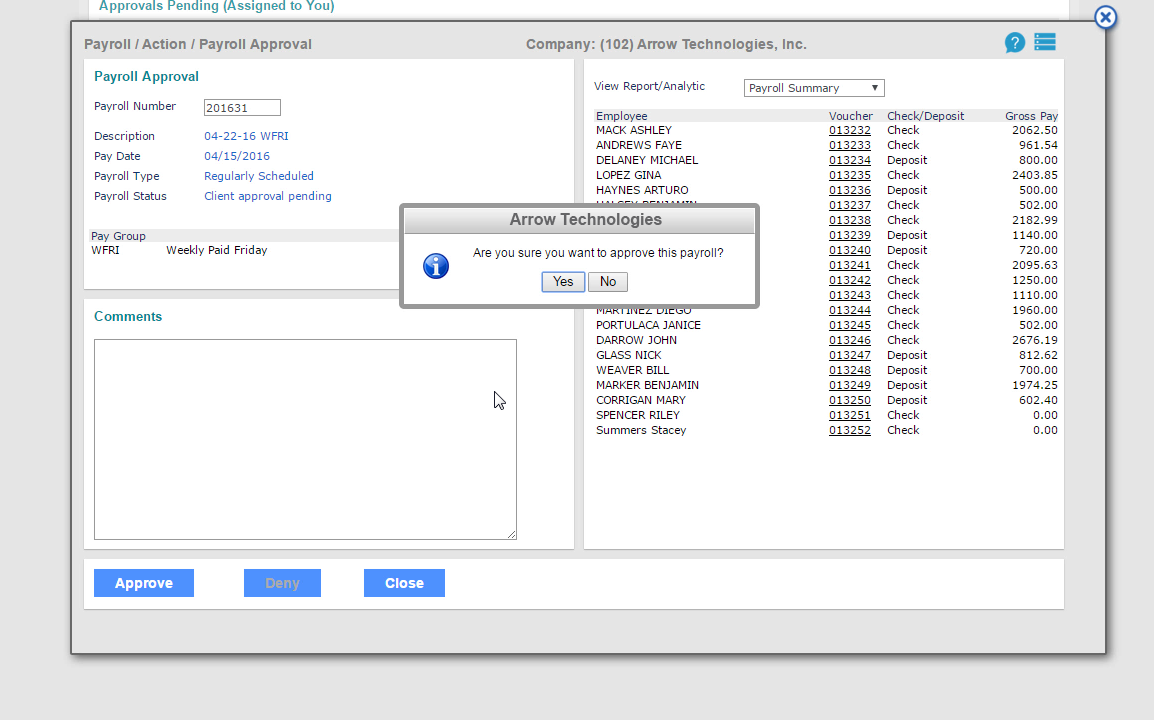

Flexible Payroll Processes and Approvals

Once you’re ready to process the payroll, you can review the payroll data through the built in reports and compare it to previous payrolls and historical averages to ensure it’s accurate. If prefer, you can print, convert to pdf, or even open the report in Excel.

Ready to Get Started?

Empower your company with solutions.